The contra account accounting reduces the total number of outstanding shares. The treasury stock account is debited when a company buys back its shares from the open market. The presence of contra expense accounts significantly influences the presentation and interpretation of financial statements. By offsetting specific expenses, these accounts ensure that the reported figures more accurately reflect the company’s net expenditures. This adjustment is particularly important for stakeholders who rely on financial statements to make informed decisions, as it provides a clearer picture of the company’s operational efficiency and cost management.

Impact on Financial Statements

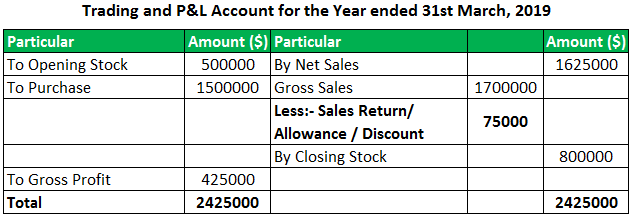

Revenue is shown on the income statement as a credit, it is the amount of revenue a business earns in a period. It might be important for a business to track the full cost of sales less contras to see the full picture. The allowance for doubtful accounts is used to reduce the net income by the estimated amount of uncollected receivables. This account helps to give a more accurate picture of the company’s financial position. In accounting, contra refers to accounts or transactions that are opposite or contrary to another account. It is a term used to describe specific types of accounts that offset the balance of related accounts, providing a clearer view of financial transactions within an organization.

What are the different types of contra accounts?

The difference between an asset’s account balance and the contra account balance is known as the book value. Contra accounts provide more detail to accounting figures and improve transparency in financial reporting. ABC Computers makes sales of 90,000; unfortunately, due to a fault in a product, they received returns of 2,500. The sales will still show a sales credit on the profit and loss of 90,000, but there is also a contra returns account with a debit of 2,500. When a company has both receivables and payables to the same business or individual, the value of one or the other is reduced.

- These accounts keep an eagle eye on sales returns, allowances, and discounts, ensuring you’re not overestimating your income.

- The initial receipt and the subsequent deduction are both logged, revealing the net effect of the transaction without distorting the total income.

- Contra Liability Account – A contra liability account is a liability that carries a debit balance and decreases other liabilities on the balance sheet.

- If customers return goods, the Sales Returns and Allowances account, a contra revenue account, is credited to offset the Sales account.

- By reporting contra accounts on the balance sheet, users can learn even more information about the company than if the equipment was just reported at its net amount.

The Company

By doing so, the company can accurately report the net expense, showcasing effective cost management and benefiting from favorable payment terms. Contra expense accounts are specialized accounts used to record reductions in specific expense categories, providing a clearer view of net expenses. These accounts are typically paired with a corresponding expense account, allowing for a more detailed and accurate representation of financial activities. For instance, if a company receives a rebate on a previously recorded expense, the rebate would be recorded in a contra expense account, effectively reducing the total expense reported.

Contra accounts are worth a look

For example, a contra accumulated depreciation account can offset a fixed asset. Contra accounts and transactions play a vital role in accounting by offsetting the balances of related accounts to provide a more accurate representation of financial transactions. Whether used to adjust asset values, liability balances, or revenue figures, understanding contra expense account examples contra is crucial for maintaining transparency and compliance with accounting principles. By grasping the concept and application of contra, accounting professionals and learners alike can ensure accurate financial reporting and informed decision-making within organizations. Companies that issue bonds are likely to use contra liability accounts.

Contra Accounts: Explained, Popular Types and Examples

It is linked to specific accounts and is reported as reductions from these accounts. If you’re valuing a low-growth company based on its equipment assets, you want to use the net value to be conservative. On the other hand, if you’re looking at a high-flying growth stock that reports new revenue growth records each quarter but has a massive allowance for doubtful accounts, there may be problems ahead. For the purpose of financial statement reporting, the amount on a contra account is subtracted from its parent account gross balance to present the net balance. When accounting for assets, the difference between the asset’s account balance and the contra account balance is referred to as the book value.

The most common one you might encounter is treasury stock—where companies buy back their own shares. It’s essentially a reverse investment; instead of pouring money in, the company is taking it back, reflecting a decrease in shareholders’ equity. This can have various strategic implications, from attempting to increase per-share earnings to trying to prevent takeovers. Contra equity accounts, therefore, act as a ledger for corporate strategy, impacting how the worth of a company is perceived from the outside. A contra equity account is an account that is used to offset another equity account on the balance sheet. Contra equity accounts are typically used for a company to buy back its stock or shares.

This account is used to estimate the amount of money that is not likely to be collected from customers. As a reminder, assets and expenses are debit accounts whereas liabilities and revenues are credit accounts. One other type of account is the contra account and for accountants, this is a must-know. The exact process can vary depending on the specific contra account and the accounting practices of the company. However, the fundamental principle is that the contra account is used to offset the related main account, providing a more nuanced view of the company’s financial position.

An estimate of bad debts is made to ensure the balance in the Accounts Receivable account represents the real value of the account. Allowance for Doubtful Accounts pairs with the Bad Debts Expense account when doing adjusting journal entries. A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification.

For example, contra revenue accounts can be used to track the full cost of sales less any discounts or returns. It can help businesses see the complete picture of their income and expenses. A contra account is a negative account that is netted from the balance of another account on the balance sheet.

This question is asked by many students, accountants, and professionals. This article will give you the definition of contra in accounting, talk about different contra accounts, and give examples. The Allowance for Doubtful Accounts is used to track the estimated bad debts a company my incur without impacting the balance in its related account, Accounts Receivable.